Autonomous Underwater Navigation Systems Market Report 2025: In-Depth Analysis of AI Integration, Market Dynamics, and Global Growth Prospects. Explore Key Trends, Forecasts, and Strategic Opportunities Shaping the Industry.

- Executive Summary & Market Overview

- Key Technology Trends in Autonomous Underwater Navigation

- Competitive Landscape and Leading Players

- Market Growth Forecasts (2025–2030): CAGR, Revenue, and Volume Analysis

- Regional Market Analysis: North America, Europe, Asia-Pacific, and Rest of World

- Future Outlook: Innovations and Emerging Applications

- Challenges, Risks, and Strategic Opportunities

- Sources & References

Executive Summary & Market Overview

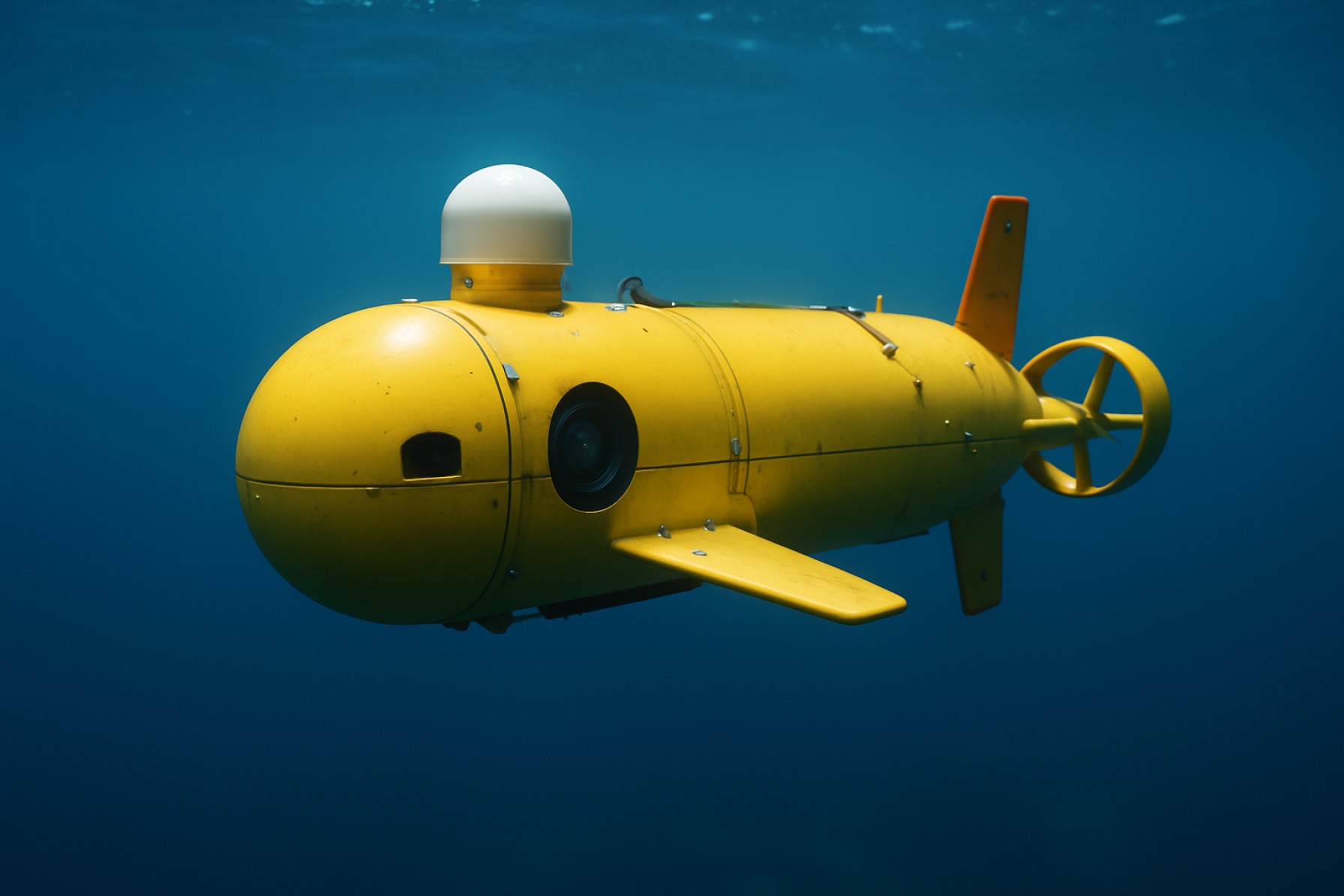

Autonomous Underwater Navigation Systems (AUNS) are advanced technologies enabling unmanned underwater vehicles (UUVs) and autonomous underwater vehicles (AUVs) to navigate complex marine environments without direct human intervention. These systems integrate sensors, artificial intelligence, and real-time data processing to facilitate precise positioning, obstacle avoidance, and mission execution in challenging underwater conditions where GPS signals are unavailable.

The global market for AUNS is experiencing robust growth, driven by expanding applications in defense, offshore energy, oceanographic research, and environmental monitoring. According to MarketsandMarkets, the autonomous underwater vehicle market is projected to reach USD 2.7 billion by 2025, growing at a CAGR of 19.8% from 2020. This surge is attributed to increased investments in maritime security, subsea infrastructure inspection, and the rising demand for deep-sea exploration.

Key industry players such as Kongsberg Maritime, Saab AB, and Teledyne Marine are at the forefront of innovation, developing sophisticated navigation solutions that leverage inertial navigation systems (INS), Doppler velocity logs (DVL), and advanced sonar technologies. These advancements are enhancing the autonomy, reliability, and operational range of underwater vehicles, enabling missions in deeper and more hazardous environments.

- Defense Sector: Navies worldwide are adopting AUNS for mine countermeasures, intelligence gathering, and surveillance, with significant procurement programs in the US, UK, and Asia-Pacific regions (Naval Technology).

- Offshore Energy: Oil & gas and renewable energy sectors utilize AUNS for pipeline inspection, subsea asset monitoring, and environmental assessments, reducing operational costs and human risk (Offshore Magazine).

- Research & Environmental Monitoring: Oceanographic institutions deploy AUNS for data collection, habitat mapping, and climate studies, supporting global efforts in marine conservation (Woods Hole Oceanographic Institution).

Looking ahead to 2025, the AUNS market is poised for continued expansion, underpinned by technological advancements, increased automation, and the growing need for persistent, reliable underwater operations. Strategic collaborations between industry leaders and research organizations are expected to accelerate innovation and broaden the scope of autonomous underwater missions worldwide.

Key Technology Trends in Autonomous Underwater Navigation

Autonomous Underwater Navigation Systems (AUNS) are at the forefront of marine technology innovation in 2025, driven by advancements in artificial intelligence, sensor integration, and communication protocols. These systems enable unmanned underwater vehicles (UUVs) and autonomous underwater vehicles (AUVs) to operate with minimal human intervention, supporting applications in oceanography, defense, offshore energy, and environmental monitoring.

One of the most significant trends is the integration of advanced sensor fusion techniques. Modern AUNS combine data from inertial navigation systems (INS), Doppler velocity logs (DVL), acoustic positioning systems, and environmental sensors to achieve precise localization and mapping even in GPS-denied environments. Companies such as Kongsberg Maritime and Teledyne Marine are leading the market with multi-sensor navigation suites that enhance reliability and accuracy for long-duration missions.

Artificial intelligence and machine learning are increasingly embedded in navigation algorithms, enabling real-time decision-making and adaptive mission planning. These technologies allow AUVs to dynamically adjust their routes in response to changing underwater conditions, obstacles, or mission objectives. According to MarketsandMarkets, the adoption of AI-driven navigation is a key factor propelling the global AUV market, which is projected to reach $2.7 billion by 2025.

Another notable trend is the development of robust underwater communication systems. Traditional acoustic modems are being supplemented with optical and electromagnetic communication technologies to improve data transfer rates and reliability. This is crucial for collaborative missions involving multiple AUVs or for real-time data transmission to surface vessels. Saab and BlueComm are among the innovators in this space, offering solutions that support high-bandwidth, low-latency underwater networking.

Energy efficiency and power management are also receiving significant attention. Advances in battery technology, such as lithium-sulfur and solid-state batteries, are extending mission endurance and reducing operational costs. Furthermore, modular and scalable system architectures are enabling easier upgrades and integration of new technologies, ensuring that AUNS remain adaptable to evolving mission requirements.

Collectively, these technology trends are transforming the capabilities of autonomous underwater navigation systems, making them more intelligent, resilient, and versatile for a wide range of commercial and defense applications in 2025.

Competitive Landscape and Leading Players

The competitive landscape for autonomous underwater navigation systems in 2025 is characterized by a mix of established defense contractors, specialized marine technology firms, and innovative startups. The market is driven by increasing demand for advanced underwater vehicles in defense, oil & gas, scientific research, and environmental monitoring. Key players are focusing on enhancing navigation accuracy, endurance, and autonomy through integration of artificial intelligence, advanced sensor fusion, and robust communication technologies.

Leading the market are companies such as Saab AB, whose Seaeye division offers a range of remotely operated and autonomous underwater vehicles equipped with proprietary navigation suites. Kongsberg Maritime is another dominant player, providing the HUGIN and Munin AUVs, which are widely used for seabed mapping and pipeline inspection, leveraging advanced inertial navigation and Doppler velocity log (DVL) systems. Teledyne Marine has a strong portfolio of navigation solutions, including the Gavia AUV and a suite of navigation and positioning sensors, catering to both commercial and defense sectors.

In the U.S., Lockheed Martin and Northrop Grumman are investing heavily in next-generation autonomous underwater systems for military applications, focusing on long-endurance and stealth capabilities. L3Harris Technologies is also notable for its Iver AUV series, which integrates modular navigation payloads for flexible mission profiles.

Emerging players such as Bluefin Robotics (a General Dynamics company) and Ocean Infinity are pushing the boundaries with swarm technology and AI-driven navigation, aiming to reduce operational costs and increase mission reliability. Startups like Seaber are gaining traction with compact, cost-effective AUVs targeting scientific and environmental monitoring markets.

- Strategic partnerships and acquisitions are common, as seen in Kongsberg Maritime’s acquisition of Hydroid to strengthen its U.S. presence.

- R&D investments are focused on improving real-time data processing, underwater communication, and resilience in GPS-denied environments.

- Regional competition is intensifying, with European and Asia-Pacific firms increasing their market share through government-backed initiatives and export programs.

Overall, the 2025 market for autonomous underwater navigation systems is highly dynamic, with innovation and strategic collaboration shaping the competitive landscape and driving technological advancement.

Market Growth Forecasts (2025–2030): CAGR, Revenue, and Volume Analysis

The market for Autonomous Underwater Navigation Systems (AUNS) is poised for robust growth between 2025 and 2030, driven by increasing demand for advanced underwater exploration, defense applications, and offshore energy operations. According to projections by MarketsandMarkets, the global autonomous underwater vehicle (AUV) market—which encompasses navigation systems as a core component—is expected to register a compound annual growth rate (CAGR) of approximately 15% during this period. This growth trajectory is underpinned by technological advancements in sensor integration, artificial intelligence, and real-time data processing, which are enhancing the precision and reliability of underwater navigation.

Revenue forecasts indicate that the AUNS segment will contribute significantly to the overall AUV market, with global revenues projected to surpass $3.5 billion by 2030, up from an estimated $1.5 billion in 2025. This surge is attributed to increased investments in maritime security, oceanographic research, and subsea infrastructure inspection, particularly in North America, Europe, and Asia-Pacific. The defense sector remains a primary driver, with navies worldwide adopting autonomous navigation solutions for mine countermeasures, surveillance, and reconnaissance missions. Meanwhile, the commercial sector is witnessing accelerated adoption for applications such as pipeline inspection, environmental monitoring, and deep-sea mining.

In terms of volume, the annual deployment of AUNS-equipped platforms is expected to grow at a CAGR of 13–16% through 2030, as reported by Fortune Business Insights. The proliferation of modular, scalable navigation systems is enabling broader use across both large and small AUVs, further expanding the addressable market. Notably, the Asia-Pacific region is anticipated to exhibit the fastest volume growth, fueled by expanding offshore energy projects and increasing maritime security initiatives.

- CAGR (2025–2030): 15% (global average)

- Revenue (2030): $3.5 billion (projected)

- Volume Growth: 13–16% CAGR in annual deployments

Overall, the 2025–2030 period is set to witness accelerated adoption and innovation in autonomous underwater navigation systems, with market growth underpinned by both technological progress and expanding end-user applications across defense, research, and commercial sectors.

Regional Market Analysis: North America, Europe, Asia-Pacific, and Rest of World

The global market for Autonomous Underwater Navigation Systems (AUNS) is experiencing robust growth, with regional dynamics shaped by defense modernization, offshore energy exploration, and advancements in marine research. In 2025, North America, Europe, Asia-Pacific, and the Rest of the World (RoW) each present distinct opportunities and challenges for AUNS adoption and innovation.

- North America: The United States leads the North American market, driven by significant investments in naval modernization and oceanographic research. The U.S. Navy’s focus on unmanned underwater vehicles (UUVs) for surveillance and mine countermeasures is a key growth driver. Canada is also investing in AUNS for Arctic exploration and environmental monitoring. The region benefits from a strong ecosystem of technology providers and research institutions, such as Lockheed Martin and Woods Hole Oceanographic Institution, fostering innovation and deployment.

- Europe: European countries are prioritizing maritime security and environmental monitoring, with the European Union funding collaborative projects under programs like Horizon Europe. The United Kingdom, Norway, and France are at the forefront, leveraging AUNS for offshore wind farm inspection and subsea infrastructure maintenance. Companies such as Saab AB and Kongsberg Gruppen are prominent players, supplying advanced navigation systems for both commercial and defense applications.

- Asia-Pacific: The Asia-Pacific region is witnessing rapid growth, propelled by territorial disputes in the South China Sea, increased defense spending, and expanding offshore energy activities. China, Japan, South Korea, and Australia are investing heavily in AUNS to enhance maritime domain awareness and resource exploration. The region’s market is characterized by government-backed R&D and partnerships with global technology firms, as seen with Mitsubishi Heavy Industries and China Shipbuilding Industry Corporation.

- Rest of World (RoW): In regions such as the Middle East, Africa, and Latin America, adoption is slower but rising, particularly for offshore oil and gas exploration and environmental monitoring. Brazil and the UAE are notable for their investments in subsea technologies, often collaborating with international suppliers to bridge capability gaps.

Overall, the regional landscape for AUNS in 2025 is shaped by a mix of defense imperatives, commercial opportunities, and environmental priorities, with each region leveraging its unique strengths and addressing specific challenges to drive market growth.

Future Outlook: Innovations and Emerging Applications

The future outlook for autonomous underwater navigation systems in 2025 is shaped by rapid technological innovation and the emergence of new applications across defense, scientific research, offshore energy, and environmental monitoring. As the demand for precise, reliable, and long-duration underwater operations grows, the industry is witnessing a shift toward more intelligent, adaptive, and networked navigation solutions.

Key innovations are centered on the integration of artificial intelligence (AI) and machine learning algorithms, which enable autonomous underwater vehicles (AUVs) to process sensor data in real time, adapt to dynamic environments, and make complex navigational decisions without human intervention. Companies such as Kongsberg Maritime and Teledyne Marine are at the forefront, developing AUVs equipped with advanced inertial navigation systems, Doppler velocity logs, and acoustic positioning technologies that enhance accuracy and operational range.

Emerging applications are expanding beyond traditional military and oil & gas sectors. In 2025, there is a notable rise in the use of autonomous navigation systems for deep-sea mining, subsea infrastructure inspection, and marine biodiversity assessment. The ability of AUVs to operate in hazardous or inaccessible environments is driving adoption in climate change research, where they collect critical data on ocean currents, temperature, and salinity. According to MarketsandMarkets, the global AUV market is projected to reach $2.7 billion by 2025, fueled by these diversified applications.

- Swarm Technology: Research is advancing toward collaborative AUV swarms, where multiple vehicles communicate and coordinate to cover larger areas efficiently, as demonstrated by projects funded by the Defense Advanced Research Projects Agency (DARPA).

- Hybrid Navigation: Combining acoustic, inertial, and visual navigation methods is improving reliability in GPS-denied environments, a critical factor for deep-sea and under-ice missions.

- Energy Innovations: Developments in battery technology and underwater wireless charging are extending mission durations, as highlighted by Saab‘s latest AUV platforms.

Looking ahead, the convergence of AI, sensor fusion, and energy management will continue to redefine the capabilities and reach of autonomous underwater navigation systems, unlocking new possibilities for ocean exploration and industrial operations in 2025 and beyond.

Challenges, Risks, and Strategic Opportunities

Autonomous Underwater Navigation Systems (AUNS) are at the forefront of marine technology, enabling unmanned underwater vehicles (UUVs) to operate with minimal human intervention. However, the sector faces a complex landscape of challenges and risks, even as it presents significant strategic opportunities for stakeholders in 2025.

One of the primary challenges is the persistent difficulty of accurate underwater positioning. Unlike terrestrial or aerial environments, GPS signals do not penetrate water, forcing reliance on inertial navigation systems, acoustic positioning, and sensor fusion. These methods are susceptible to drift, signal attenuation, and environmental noise, which can degrade navigational accuracy over time and distance. This technical limitation is particularly acute for deep-sea and long-duration missions, where cumulative errors can compromise mission objectives and safety (National Academies of Sciences, Engineering, and Medicine).

Operational risks also loom large. The harsh and unpredictable underwater environment exposes AUNS to mechanical failures, biofouling, and unexpected obstacles. Additionally, cybersecurity threats are rising as AUNS become more networked and reliant on remote communications, making them potential targets for data breaches or malicious interference (NATO).

From a regulatory perspective, the lack of standardized protocols for autonomous underwater operations creates uncertainty for manufacturers and operators. International waters, in particular, present a legal grey area regarding data collection, environmental impact, and liability in the event of accidents or system failures (International Maritime Organization).

Despite these challenges, strategic opportunities abound. The growing demand for subsea exploration, offshore energy, and environmental monitoring is driving investment in advanced AUNS. Innovations in artificial intelligence, sensor miniaturization, and energy-efficient propulsion are expected to enhance system reliability and autonomy. Strategic partnerships between defense agencies, research institutions, and private sector players are accelerating the development and deployment of next-generation systems (Lockheed Martin).

In summary, while the AUNS market in 2025 is constrained by technical, operational, and regulatory risks, it is also positioned for robust growth as technological advancements and cross-sector collaborations unlock new applications and efficiencies.

Sources & References

- MarketsandMarkets

- Kongsberg Maritime

- Saab AB

- Teledyne Marine

- Naval Technology

- Offshore Magazine

- Lockheed Martin

- Northrop Grumman

- L3Harris Technologies

- Ocean Infinity

- Seaber

- Fortune Business Insights

- Mitsubishi Heavy Industries

- Defense Advanced Research Projects Agency (DARPA)

- National Academies of Sciences, Engineering, and Medicine

- International Maritime Organization