Table of Contents

- Executive Summary: Market Drivers and 2025 Snapshot

- Technology Overview: Principles of Graphene-Based High-Throughput Analyte Sensors

- Key Industry Players and Latest Innovations

- Market Size, Growth Projections & Regional Trends (2025–2030)

- Emerging Applications: Healthcare, Environmental Monitoring, and Beyond

- Competitive Landscape: Partnerships, M&A, and Ecosystem Dynamics

- Regulatory and Standards Developments

- Challenges: Scalability, Cost, and Integration

- Future Outlook: Next-Gen Sensor Technologies and Disruptive Opportunities

- Company Case Studies: Real-World Deployments and Commercialization Efforts

- Sources & References

Executive Summary: Market Drivers and 2025 Snapshot

Graphene-based high-throughput analyte sensors are poised for significant commercial and technological advancement in 2025, driven by the convergence of materials innovation, increasing demand for rapid diagnostics, and the scalability of sensor manufacturing. The core market drivers include the unique electrical, mechanical, and chemical properties of graphene, which enable ultra-sensitive, selective, and rapid detection of a wide array of analytes—from biomolecules and pathogens to environmental toxins. These advantages make graphene a pivotal material in next-generation sensor platforms for healthcare, environmental monitoring, industrial process control, and food safety applications.

In 2025, the adoption of graphene-based sensors is being accelerated by the need for decentralized and high-throughput analytical solutions. The COVID-19 pandemic has underscored the importance of rapid and scalable diagnostic technologies, prompting substantial investments in biosensor R&D and production infrastructure. The healthcare sector, in particular, is witnessing increased integration of graphene sensors into point-of-care diagnostic devices due to their high sensitivity and low detection limits. Several companies, including Graphenea and First Graphene, are actively collaborating with device manufacturers to enable mass production of sensor components suitable for high-throughput workflows.

Major industry players are leveraging advances in large-area graphene synthesis and functionalization techniques to improve sensor reproducibility and scalability. For example, Graphenea supplies CVD-grown graphene optimized for biosensor applications, while First Graphene is advancing the use of high-purity graphene for industrial sensing platforms. These developments are reducing costs and facilitating regulatory approvals, further driving market adoption.

The outlook for 2025 and the subsequent few years indicates continued expansion, with multi-analyte detection and miniaturization emerging as key trends. Sensor integration with IoT frameworks and data analytics is expected to enable real-time, remote monitoring across multiple sectors. Regulatory momentum, such as the growing emphasis on traceability and safety in food and pharmaceuticals, is also catalyzing demand. Industry associations, including the Graphene Flagship, are supporting collaborative efforts to accelerate standardization and commercialization.

In summary, 2025 marks a pivotal year for graphene-based high-throughput analyte sensors, characterized by robust investment, technology maturation, and expanding end-use cases. The sector is set to benefit from ongoing materials innovation and cross-sector partnerships, positioning graphene sensors as a core component of the next wave of analytical technologies.

Technology Overview: Principles of Graphene-Based High-Throughput Analyte Sensors

Graphene-based high-throughput analyte sensors leverage the remarkable physical and chemical properties of graphene—a single layer of carbon atoms arranged in a hexagonal lattice—to enable rapid, sensitive detection of a wide range of biological and chemical analytes. The core principle underlying these sensors is graphene’s exceptionally high surface-to-volume ratio, electrical conductivity, and inherent biocompatibility, which collectively facilitate the real-time transduction of molecular interactions into measurable electronic signals.

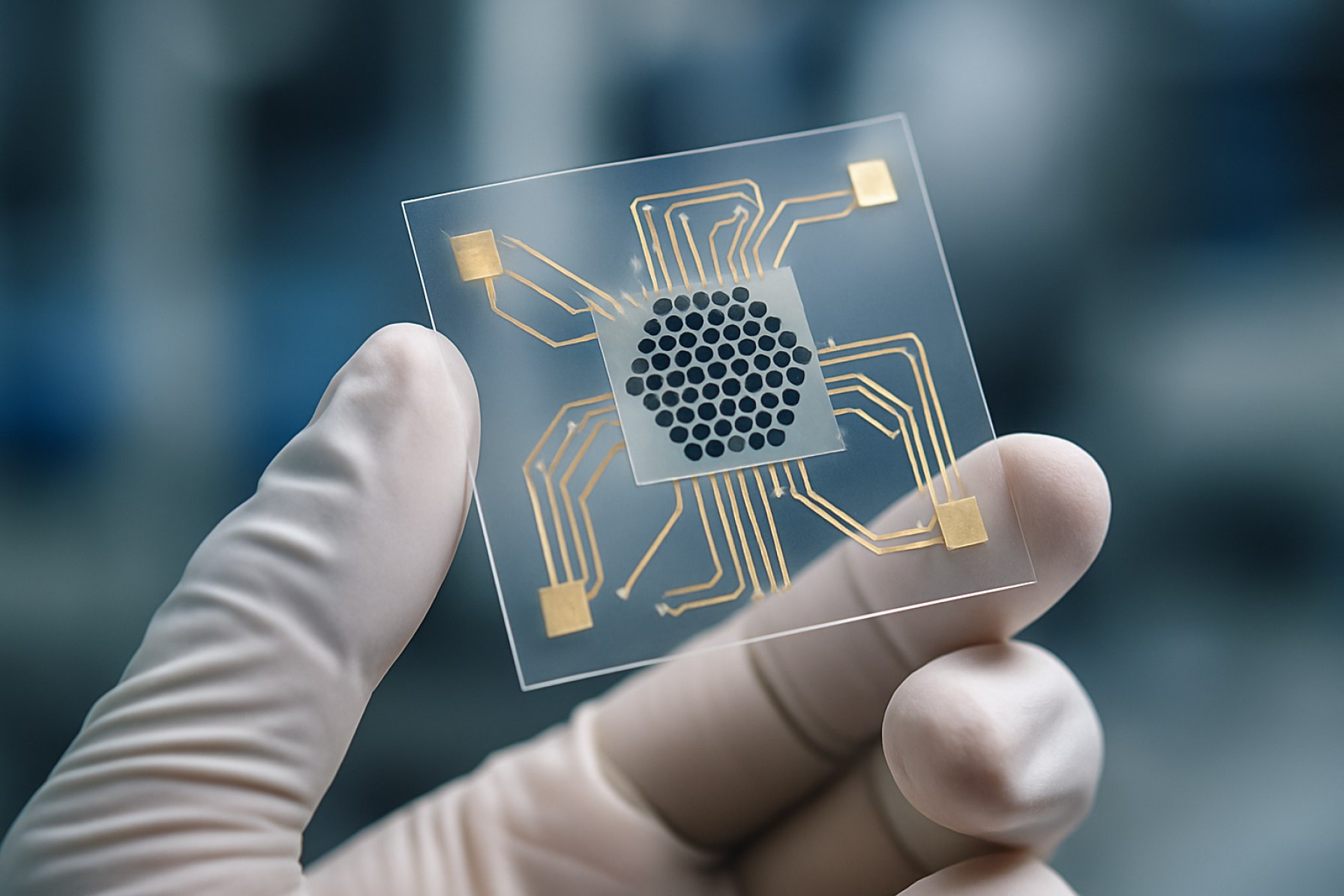

In typical sensor architectures, graphene is utilized either as a field-effect transistor (FET) channel or as a functionalized sensing surface. When analyte molecules, such as proteins, nucleic acids, or small chemicals, bind to graphene’s surface (often functionalized with specific recognition elements like antibodies or aptamers), the electronic properties of graphene—primarily its conductivity and carrier mobility—are modulated. This modulation is then translated into a quantifiable signal, enabling highly sensitive detection, often down to the single-molecule level.

A defining feature of high-throughput graphene-based analyte sensors is their integration with microarray and multiplexed platforms. Arrays of graphene sensor elements can be individually functionalized, allowing simultaneous detection of multiple analytes in parallel. This architecture is particularly valuable for clinical diagnostics, environmental monitoring, and food safety testing, where rapid, multi-target analysis is required.

Recent advances focus on scalable manufacturing and device integration. Several companies and research consortia are developing wafer-scale graphene synthesis and transfer processes to enable mass production of sensor chips. For instance, Graphenea supplies large-area, high-quality graphene materials for device integration, while NovaMatrix (by NovaMaterial) and First Graphene are advancing graphene production for commercial applications. Device manufacturers such as Nano Medical Diagnostics and Graphene Tracker are actively commercializing graphene-based biosensor platforms, with ongoing product launches and pilot programs anticipated to accelerate through 2025 and beyond.

Looking ahead, the technology landscape in 2025 is characterized by a shift from laboratory demonstrations to robust, scalable sensor platforms with integrated electronics and data analytics. Companies and industry groups are collaborating to define standards for device performance and reproducibility. Continued improvements in graphene transfer, patterning, and functionalization are expected to drive further gains in sensor sensitivity, selectivity, and throughput, positioning graphene-based sensors as a key enabling technology in next-generation diagnostics and screening applications.

Key Industry Players and Latest Innovations

The landscape of graphene-based high-throughput analyte sensors is witnessing significant momentum in 2025, marked by rapid advancements and strategic initiatives from leading industry players. The sector’s evolution is fueled by graphene’s exceptional electrical, mechanical, and surface properties, which have enabled the development of ultrasensitive and multiplexed biosensing platforms for medical diagnostics, environmental monitoring, and industrial applications.

One of the foremost innovators in this space is Graphenea, a European graphene manufacturer that has consistently expanded its offerings of high-quality graphene films and related devices. In 2024, the company announced enhanced graphene field-effect transistor (GFET) arrays tailored for biosensor production, enabling scalable, reproducible fabrication of sensor chips compatible with high-throughput workflows. Their ongoing collaboration with diagnostic device manufacturers is expected to yield integrated sensor platforms optimized for rapid, multiplexed detection of biomarkers by 2025.

Another pivotal player is Versarien plc, which, through its subsidiary Gnanomat, has focused on composite materials integrating graphene for sensor electrodes. Their latest developments leverage functionalized graphene to improve specificity and signal-to-noise ratios in analyte sensing. In 2025, Versarien is partnering with automation solution providers to streamline sensor production, targeting mass deployment in environmental and industrial monitoring systems.

Asia-Pacific companies are also at the forefront. First Graphene Limited, headquartered in Australia, has scaled up the supply of high-purity graphene nanoplatelets, supporting sensor manufacturers with consistent raw materials for high-throughput device fabrication. The company’s recent supply agreements with biosensor startups in Southeast Asia underscore the region’s rapidly growing demand for next-generation diagnostic sensors.

On the technology innovation front, Oxford Instruments continues to advance deposition and nanofabrication tools crucial for producing wafer-scale graphene sensor arrays. Their systems are enabling sensor manufacturers to achieve precise control over graphene layer quality and device miniaturization, both essential for high-throughput applications.

Looking ahead to the next few years, industry leaders are concentrating on integrating graphene sensors with microfluidics and AI-powered analytics for fully automated, point-of-care solutions. Cross-sector collaborations and standardization efforts are anticipated to accelerate commercial adoption. As manufacturing scalability and device reproducibility improve, graphene-based high-throughput analyte sensors are poised to play a transformative role in diagnostics and monitoring ecosystems globally.

Market Size, Growth Projections & Regional Trends (2025–2030)

The market for graphene-based high-throughput analyte sensors is poised for significant expansion between 2025 and 2030, driven by escalating demand in healthcare diagnostics, environmental monitoring, and industrial process control. As of early 2025, the sector is characterized by an increasing number of commercial deployments, with major advancements in sensor miniaturization, multiplexing capabilities, and integration into automated laboratory and point-of-care systems.

Several pioneering companies in the graphene domain—including Graphenea, Directa Plus, and Haydale Graphene Industries—are actively expanding their product portfolios to cater to the biosensing and environmental analysis markets. These organizations have ramped up production capacities, with Graphenea reporting increased supply of high-quality graphene sheets tailored for sensor applications, and Haydale Graphene Industries focusing on functionalized graphene for enhanced selectivity and stability in analyte detection.

Regionally, Asia-Pacific is emerging as a dominant force, underscored by sustained investments from both the public and private sectors. China, South Korea, and Japan, in particular, are witnessing robust government-backed R&D efforts and strategic collaborations with local manufacturers. For instance, Graphenea has reported new distribution partnerships in East Asia to support sensor manufacturers. In Europe, the push is led by regulatory incentives for advanced diagnostics and environmental compliance, while North America maintains a strong presence through university-industry collaborations and the integration of graphene sensors into next-generation medical devices.

Outlook for 2025 and beyond indicates that the annual growth rate for the sector will likely exceed that of traditional sensor markets, due to the unique properties of graphene—such as extraordinary electrical conductivity and large surface-to-volume ratio—enabling ultra-sensitive, multiplexed detection in compact formats. The proliferation of automated laboratories and decentralized testing models is expected to be a key driver, as manufacturers like Directa Plus and Haydale Graphene Industries continue to announce pilot projects and commercial launches targeting clinical and environmental applications.

- Asia-Pacific is projected to lead market share by 2030, supported by large-scale sensor deployments in healthcare and pollution monitoring.

- Europe’s growth will be catalyzed by regulatory frameworks favoring rapid diagnostics and green technologies.

- North America will capitalize on the integration of graphene sensors into digital health platforms and industrial IoT networks.

Overall, from 2025 through 2030, graphene-based high-throughput analyte sensors are set for strong adoption and market growth, with regional dynamics shaped by policy, investment, and manufacturing ecosystem maturity.

Emerging Applications: Healthcare, Environmental Monitoring, and Beyond

Graphene-based high-throughput analyte sensors are poised to transform several application domains in 2025 and the near future, with healthcare and environmental monitoring at the forefront. The intrinsic properties of graphene—exceptional electrical conductivity, high surface area, and flexibility—enable rapid, sensitive, and multiplexed detection of a variety of analytes, including biomolecules, pathogens, toxins, and environmental pollutants.

In healthcare, 2025 is witnessing increased integration of graphene sensors into devices for point-of-care diagnostics and continuous patient monitoring. For example, graphene field-effect transistor (GFET) arrays are being incorporated in platforms to simultaneously detect multiple biomarkers at ultra-low concentrations, crucial for early disease detection and personalized medicine. Companies such as Graphenea and Versarien are advancing the commercial availability of graphene materials suitable for biosensing device fabrication, supporting the scale-up of clinical-grade sensor production. Recent developments include wearable patches with graphene-based sensing elements capable of monitoring metabolites and vital signs in real-time, leveraging biocompatibility and mechanical durability for skin-contact applications.

Environmental monitoring is another rapidly expanding field for high-throughput graphene sensors. The ongoing transition toward decentralized, continuous monitoring of air and water quality is being accelerated by sensor arrays capable of detecting various chemical contaminants, heavy metals, and microbial pathogens with high sensitivity and selectivity. Organizations such as Directa Plus are supplying graphene materials for integration into smart environmental sensing networks, enabling large-scale deployments in cities, industrial sites, and water treatment facilities. Key advantages include rapid analyte response times and the ability to multiplex, allowing simultaneous detection of several pollutants or toxins.

Beyond healthcare and environmental sectors, graphene-based analyte sensors are finding applications in food safety, industrial process control, and agricultural monitoring. Sensor companies are collaborating with material suppliers to develop compact devices for in-line quality assurance, crop health analysis, and spoilage detection, exploiting graphene’s chemical sensitivity and robustness. The adoption of roll-to-roll manufacturing and scalable printing techniques is anticipated to reduce costs and support broader commercialization within the next few years.

Looking ahead, 2025 and beyond will likely see further convergence of graphene-based sensor technology with artificial intelligence and IoT platforms, enabling autonomous, real-time data analytics and actionable insights. The continued efforts by material producers such as Graphenea, Directa Plus, and Versarien are expected to drive both performance improvements and market adoption across diverse sectors.

Competitive Landscape: Partnerships, M&A, and Ecosystem Dynamics

The competitive landscape for graphene-based high-throughput analyte sensors in 2025 is characterized by intensifying collaboration, strategic acquisitions, and dynamic ecosystem development as organizations seek to capitalize on the unique properties of graphene for advanced sensor technologies. With a growing emphasis on applications in healthcare diagnostics, environmental monitoring, and industrial process control, key industry players are leveraging partnerships and joint ventures to accelerate commercialization and scale manufacturing.

A prominent trend is the collaboration between graphene material specialists and sensor device manufacturers. For instance, Graphenea, a leading graphene producer, has expanded its ecosystem by partnering with sensor integrators and research institutes to refine graphene transfer and patterning processes, aiming to deliver reproducible, scalable sensor platforms. Such cross-disciplinary partnerships are essential for addressing challenges such as device consistency and integration into existing analytical workflows.

Strategic investments and acquisitions have also become central to market consolidation. Notably, Directa Plus has pursued both joint development agreements and targeted acquisitions to enhance its intellectual property portfolio and diversify its sensor material offerings. Similarly, Versarien has focused on ecosystem building by collaborating with both multinational electronics firms and emerging medtech startups to co-develop biosensor solutions, thereby expanding its reach into high-value diagnostic markets.

The ecosystem further benefits from the active involvement of national initiatives and consortia. For example, Graphene Flagship, one of the largest European research initiatives, continues to foster collaboration among academic groups, end users, and industrial partners, which is instrumental in driving standardization and accelerating technology transfer from lab to market. This pan-European network has enabled pilot production lines and facilitated joint ventures between SMEs and large-scale manufacturers for sensor commercialization.

Looking ahead to the next few years, the competitive landscape is expected to see increased vertical integration through mergers and acquisitions as companies seek to secure supply chains and proprietary process know-how. The sector is also likely to witness more public-private partnerships, particularly as governments and healthcare systems invest in rapid diagnostic infrastructure. As graphene sensor performance benchmarks are established, the entry barrier may rise, consolidating market share among early movers who have secured key partnerships and intellectual property. Overall, the evolving ecosystem reflects both the promise and the complexity of scaling graphene-based high-throughput analyte sensor technologies for mainstream adoption.

Regulatory and Standards Developments

The regulatory and standards landscape for graphene-based high-throughput analyte sensors is undergoing significant evolution as this emerging technology transitions from laboratory research to commercial deployment. In 2025, several pivotal events are shaping the framework for safety, performance, and quality assurance in this domain. Regulatory bodies and standardization organizations are working to address the unique properties and challenges associated with graphene, particularly regarding its integration into sensor platforms for healthcare, environmental monitoring, and industrial analytics.

A major focus has been the ongoing efforts of the International Organization for Standardization (ISO) and European Committee for Standardization (CEN) in updating and expanding standards pertaining to the characterization, terminology, and testing of graphene materials. The ISO Technical Committee 229 on Nanotechnologies continues to develop guidance documents specifically addressing the measurement methods and data quality requirements for graphene used in sensor applications. In parallel, CEN has strengthened collaboration with European regulatory agencies to align standards with regulatory expectations for safety and environmental impact assessments.

On the regulatory front, the European Union’s European Commission has been proactive, particularly through the Registration, Evaluation, Authorisation and Restriction of Chemicals (REACH) framework. In 2025, updates to REACH are increasingly referencing nanomaterial-specific dossiers, including those related to graphene and functionalized derivatives, aiming to clarify the obligations of manufacturers and users of graphene-based sensors regarding risk assessment and labeling.

In the United States, the U.S. Food and Drug Administration (FDA) has issued new draft guidance relevant to the use of novel nanomaterials, including graphene, in medical devices. These guidelines emphasize the need for thorough biocompatibility, toxicity, and leachables testing, with particular scrutiny applied to high-throughput biosensors intended for clinical diagnostics. The FDA’s Center for Devices and Radiological Health is also piloting new programs to streamline the premarket review process for nanomaterial-enabled sensors, aiming to balance innovation with patient safety.

Looking ahead, industry consortia such as the Graphene Flagship are playing a key role in harmonizing standards and sharing best practices across manufacturers and research institutions. Their collaborative projects are expected to produce reference materials and validated protocols for sensor performance evaluation within the next few years. Additionally, as international harmonization of standards accelerates, it is anticipated that regulatory clarity will drive broader adoption and facilitate the commercialization of graphene-based high-throughput analyte sensors in multiple sectors.

Challenges: Scalability, Cost, and Integration

Graphene-based high-throughput analyte sensors hold significant promise for revolutionizing analytical and diagnostic platforms in 2025 and the coming years. However, their widespread adoption faces persistent challenges related to scalability, cost, and integration into existing workflows and devices.

One of the most significant barriers to the commercial deployment of these sensors is the scalable and reproducible production of high-quality graphene. Traditional methods such as mechanical exfoliation yield superior graphene sheets but lack the throughput and uniformity required for industrial-scale sensor fabrication. Chemical vapor deposition (CVD) has emerged as a leading method for larger-scale production, but it often involves high temperatures, complex transfer processes, and contamination risks that can impair sensor performance. Companies like Graphenea and Oxford Instruments are actively developing CVD and related technologies, but as of 2025, achieving wafer-scale, defect-free, and cost-effective graphene remains a technical and economic hurdle.

Cost is another central challenge. Even as advances in synthesis and transfer methods have reduced the price per square centimeter of graphene, the raw material and processing costs still exceed those of established sensor materials. Moreover, integrating graphene into high-throughput analyte sensor platforms often requires additional steps—such as surface functionalization and precise patterning—that further increase manufacturing complexity and expense. According to industry sources, the price point for high-quality, electronics-grade graphene is expected to decrease as production capacity ramps up, but parity with conventional sensor materials may not be realized until later in the decade.

Integration into existing sensor architectures and readout systems also poses significant obstacles. Graphene’s unique electrical and chemical properties necessitate new approaches to device design, packaging, and data interpretation. Ensuring compatibility with standard microfabrication processes and automated assay platforms is a complex engineering challenge. Efforts from companies such as Sensirion, which is exploring advanced sensor integration, are indicative of broader industry trends, but universal standards and plug-and-play solutions for graphene-based sensors are not yet mature. Furthermore, ensuring long-term stability and reliability of graphene interfaces—critical for clinical and industrial deployment—remains an area of active research and development.

Looking ahead to the next few years, continued investment in scalable synthesis, streamlined integration processes, and cost reduction strategies will be critical to overcoming these challenges. Collaboration among material suppliers, sensor manufacturers, and end-users will likely accelerate the translation of graphene-based high-throughput analyte sensors from laboratory prototypes to widespread commercial adoption.

Future Outlook: Next-Gen Sensor Technologies and Disruptive Opportunities

Graphene-based high-throughput analyte sensors are poised for significant advancements in 2025 and the following years, driven by accelerating developments in materials science, scalable fabrication methods, and integration with digital analytics. The exceptional electrical, mechanical, and chemical properties of graphene, including its high carrier mobility and large surface-to-volume ratio, continue to underpin its disruptive potential for ultra-sensitive and multiplexed detection platforms.

Several key events in 2024 and early 2025 have highlighted the transition of graphene-based sensors from laboratory prototypes to commercially viable solutions. Companies such as Graphenea and Vorbeck Materials have showcased scalable manufacturing of graphene films and inks compatible with sensor production lines, enhancing reproducibility and cost-efficiency. Graphene Platform Corporation has expanded its range of sensor-ready graphene substrates, accelerating time-to-market for device developers.

Industry collaborations with healthcare and environmental monitoring sectors are catalyzing the deployment of graphene-based analyte sensors in real-world applications. For instance, the integration of graphene field-effect transistors (GFETs) into point-of-care diagnostic devices is being pursued actively, with companies such as Abbott Laboratories and Siemens Healthineers investigating the incorporation of next-gen graphene sensors into their biosensing portfolios. This trend is expected to accelerate in 2025 as regulatory bodies provide clearer guidance on the validation of nanomaterial-enabled diagnostics.

On the technological front, advances in functionalization techniques—such as the use of bio-recognition elements and anti-fouling coatings—are improving selectivity and stability, addressing longstanding challenges of non-specific binding and sensor drift. Consortium initiatives, such as those coordinated by the Graphene Flagship, aim to standardize sensor performance metrics and foster interoperability, expediting commercialization across Europe and beyond.

Looking ahead, the convergence of graphene-based sensors with artificial intelligence and cloud analytics is set to transform high-throughput analyte detection. Edge-computing enabled sensor arrays will allow real-time, decentralized analysis of complex biological and environmental samples. Market-ready platforms are anticipated by 2026–2027, with robust pilot deployments in clinical diagnostics, food safety, and air/water quality monitoring. As ecosystem players—ranging from material suppliers to device integrators—align on open standards and validated manufacturing methods, graphene-based high-throughput sensors are positioned to disrupt traditional analytical workflows, reducing costs and enhancing accessibility on a global scale.

Company Case Studies: Real-World Deployments and Commercialization Efforts

Graphene-based high-throughput analyte sensors have seen notable progress in real-world deployments and commercialization, particularly as the need for rapid, sensitive, and multiplexed detection platforms expands across healthcare, environmental monitoring, and food safety. In 2025, several companies are demonstrating leadership in bridging the gap between laboratory prototypes and scalable, market-ready products.

A prominent example is Graphenea, which continues to supply high-quality graphene materials and collaborates with sensor manufacturers to integrate graphene into biosensor arrays. Their production of wafer-scale graphene is underpinning the roll-out of next-generation sensor chips designed for parallel analyte detection, enabling real-time diagnostics in clinical and point-of-care settings. Graphenea’s partnerships with device companies have reportedly facilitated pilot deployments in hospital networks, where the sensors are being trialed for infectious disease panels and metabolic monitoring.

Another key player, Sensirion, has made strategic investments in graphene sensor technology, focusing on environmental and air quality monitoring. By integrating graphene’s high sensitivity and rapid response times into multiplexed sensor arrays, Sensirion is targeting industrial and smart city applications. In 2025, field tests are underway in several European municipalities to monitor airborne particulates and volatile organic compounds, with the goal of providing real-time data for urban pollution management.

In the food safety sector, AbsoluteMems is advancing graphene-based sensors for high-throughput detection of contaminants and pathogens. Their sensor platforms leverage graphene’s unique electrical properties to enable simultaneous multi-analyte screening within food processing facilities. Commercial trials in 2025 are focused on rapid detection of pesticide residues and bacterial contamination, aiming to enhance traceability and reduce recall risks.

Looking ahead, the commercial outlook for graphene-based high-throughput analyte sensors is buoyed by ongoing improvements in graphene synthesis scalability and sensor microfabrication techniques. Companies are increasingly demonstrating robust sensor performance in complex, real-world environments, moving beyond proof-of-concept toward certified, field-deployable products. As regulatory validation progresses and costs decline, wider adoption is anticipated in healthcare diagnostics, environmental surveillance, and agri-food industries over the next several years.

Sources & References

- First Graphene

- Nano Medical Diagnostics

- Versarien plc

- Oxford Instruments

- Directa Plus

- Haydale Graphene Industries

- Versarien

- Directa Plus

- International Organization for Standardization

- European Committee for Standardization

- European Commission

- Sensirion

- Graphene Platform Corporation

- Siemens Healthineers